We Pulled Shoppable Content Off Social—Did Sales Tank or Skyrocket?

TL;DR: The Fast Math on Margins, AOV, and Ownership

Think of this as quick accounting with a wink: take the fee you used to give to social platforms and imagine it landing back in your business bank account. If a platform skimmed 15% and your gross margin before that was 40%, selling direct can feel like an instant margin bump. That extra percent point is fuel for ads, fulfillment, or better packaging.

Average order value is the secret lever that scales that margin bump. If you can lift AOV from $50 to $60 with simple bundles or guaranteed shipping, revenue per conversion grows 20 percent with almost zero change in acquisition cost. Even a modest AOV lift converts into bigger dollars at the bottom line, since fixed costs per order stay roughly the same.

Owning the checkout and customer record compounds the effect. With direct data you can chase a 25 percent repeat purchase rate instead of 10 percent, and lifetime value rises steeply. If you want help getting initial reach without the social storefront, consider a targeted service like cheap instagram boosting service to jumpstart traffic while you lock in first-party data.

Tactical moves that actually work: price anchoring, one-click upsells, subscription trials, and post purchase email flows. Measure AOV, gross margin percent, repeat rate, and cost per acquisition in parallel. Small optimizations in each bucket stack quickly.

Short experiment plan: run a 30 day split test, track the four KPIs above, and allocate the regained margin to the highest ROI channel. The math is simple, the moves are clear, and the payoff is bigger than the brand brag on social.

Where to Put It: Landing Pages, Blogs, Email, and Surprisingly High-Converting FAQs

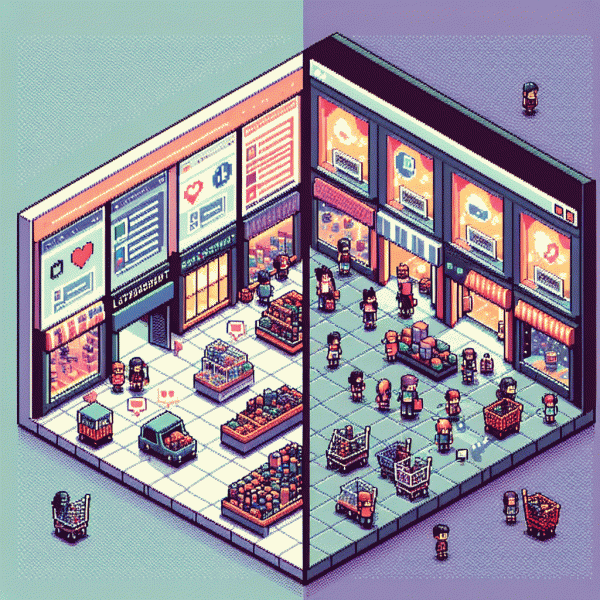

Taking shoppable content off social gives you something rarer than a unicorn: control. On your own site and channels you control layout, load speed, tracking, and the checkout experience. Start by mapping top-performing social moments to owned destinations and prioritize pages where people already have intent — product detail, category landing, and single-purpose microsites.

Landing pages are the money pages. Keep one clear action, reduce options, and surface the product above the fold with a bold price and a single strong CTA. Use modular blocks for color and size swatches, mini-reviews, and a visible returns snippet so visitors can buy without extra clicks. Run A/Bs on headline, hero image, and button copy and watch conversion rates climb.

Blogs are conversion engines when they stop playing coy. Embed inline buy buttons next to product mentions, add a compact product card at the top of the post, and intersperse contextual links to related items. The SEO upside is real: long-form content captures discovery queries and funnels readers straight into transactional pages where intent is easier to monetize.

Email is the workhorse that actually closes. Build shoppable blocks that take readers to product anchors or one-click buy flows, and use dynamic content to show items based on browsing or cart data. Sequence abandoned-cart and browse-abandonment flows with urgency and clear benefits, and track by campaign and product ID to attribute revenue cleanly.

Finally, do not sleep on the FAQ page. A well-structured Q&A with buy buttons and schema markup converts skeptics by answering objections at the moment of decision. Test placing "Where to buy" and sizing answers above technical info, treat FAQ as a lightweight product page, and run a simple experiment — you may be surprised by the lift.

What It Costs: Build vs Buy and the Hidden Taxes of Staying on Instagram

Pulling shoppable content off social forces a math problem: do you invest to rebuild a direct checkout experience or double down on paid placements and third party services? The headline costs are obvious — developers, design, subscription fees — but the real damage comes from platform taxes: algorithmic reach that can vanish overnight, payment commissions, and the slow bleed of customer data that stays on someone else s server.

Building in house means engineering time to stitch together product pages, carts, payments, security, and analytics. Expect months of work, ongoing maintenance, and surprises like mobile performance fixes and return handling. One time budgets can balloon fast; set realistic windows such as weeks to months to launch and line items for testing, hosting, and compliance.

Buying back commerce via platforms or SMM services swaps capital expense for recurring bills: platform fees, ad spend, influencer retainers, and SaaS subscriptions for shop features. That model is attractive for speed, but it creates recurring margin pressure and a reliance on API stability and platform rules, which can change without notice and increase your effective cost per order.

The hidden taxes are subtle but measurable: higher customer acquisition cost, limited first party data, lower lifetime value due to weaker brand ownership, and friction when the platform tweaks the checkout flow. Track CAC, LTV, churn rate, and return on ad spend before deciding. Run short tests so you do not lock into a cost structure that kills profitability.

Be pragmatic: run a 90 day experiment, require email or SMS capture on every purchase, and design modular systems so components can be replaced. Negotiate clear SLAs with vendors and prioritize owning the relationship with customers. That mix of build and buy is often the fastest path to maintaining sales momentum without paying rent to a platform forever.

UX That Sells: Make Content Shop-Ready Without Killing Readability

When you move commerce off social and into your own pages, every pixel needs to pull its weight. Think of UX as the in-store salesperson who never blunders. Use clear visual hierarchy: bold product names, concise benefit lines, and a single, unmistakable primary action. Keep microcopy under 12 words, show price early, and let imagery do the heavy lifting so readers can scan and still know what to buy.

Make shopping feel native without cluttering content. Use inline product cards that expand on demand, not full-page takeovers; progressive disclosure keeps readability intact. Add consistent affordances — the same button color and label across items — so muscle memory guides clicks. Preserve white space, limit decorative styling, and optimize media so images load instantly. Small touches like hover zoom and tappable hotspots increase confidence without interrupting the narrative.

Reduce friction where conversions happen. Offer guest checkout, bold a single CTA per view, and prefill shipping fields when possible. Show trust signals close to the CTA: ratings, return policy, and security badges. Keep upsells subtle — a relevant accessory rather than a pop-up — and surface live inventory to prevent disappointment. When payment steps are predictable, users spend less time hesitating and more time completing orders.

Measure the tiny moments: scroll depth, CTA clicks, add-to-cart after image interaction. Run short A/B tests on label text and button placement, then iterate quickly. Treat readability as a KPI alongside conversion: if bounce drops and revenue rises, you nailed the balance. Design for clarity first, commerce second, and the sales will follow without sacrificing the story.

Show Me the Proof: Quick Case Wins, Benchmarks, and a 14-Day Test Plan

Want the proof without the puff? Here are compact wins and a test you can run in two weeks to know if pulling shoppable content off social helped your bottom line or not. No hypotheses, just measurable playbooks, quick wins you can replicate, and a simple decision gate at day 14.

Real quick wins our teams have seen in pilot swaps:

- 🆓 Free: Reducing checkout distractions by sending traffic to a single product page lifted add to cart by 18 percent in one fashion pilot.

- 🚀 Fast: Replacing shoppable tags with a focused landing reduced checkout time and increased conversion rate by 12 to 20 percent in electronics tests.

- 🔥 Scalable: Switching to owned pages cut return visits needed to convert by 30 percent, improving paid media ROAS across channels.

Benchmarks to use as your north star: expect CTR to drop slightly but conversion rate to improve, with net revenue per visitor up 10 to 35 percent depending on category. Average order value often climbs 5 to 15 percent when you remove social browsing noise. Target a 2x payback on campaign spend inside 14 days as a conservative success metric.

Execute this 14 day plan: days 1 to 3 set up two control pages and one streamlined product landing, days 4 to 10 run matched creative to each variant and measure CTR, add to cart, and purchases, days 11 to 13 optimize creatives and retarget top engagers, day 14 close the loop and decide. If you want a fast traffic seed to run the test use boost instagram as a launchpad.