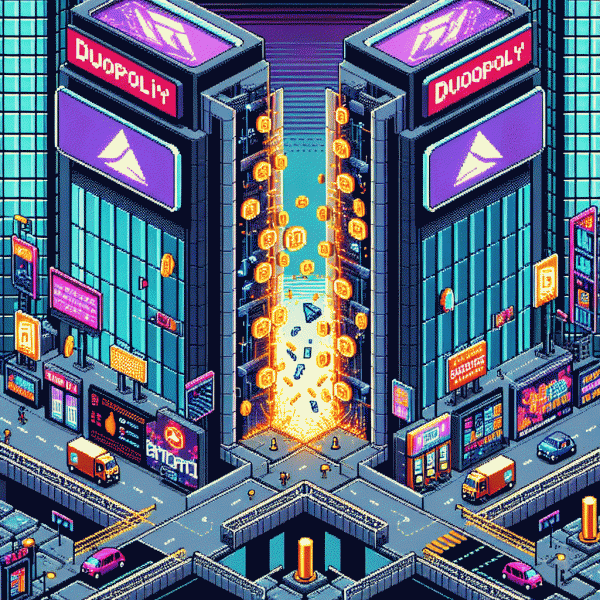

Escape the Duopoly: Ad Networks Quietly Printing ROAS Beyond Meta and Google

Retail Media Rockets: Amazon, Walmart, and Instacart Where Intent Lives

Retail platforms are digital aisles built around ready-to-buy moments. Amazon, Walmart, and Instacart combine search intent, basket signals, and logged purchase histories so ads meet customers at checkout-minded stages. That deterministic first-party data often produces higher conversion rates and cleaner attribution than blasting generic creative at a social feed.

Tactics that work: prioritize bottom-funnel placements like Sponsored Products and Buy Box levers, layer keyword plus category targeting, and push SKU-specific creative that highlights price, availability, and one clear benefit. Use product titles and images as ad creative; test badges such as fast delivery and strong ratings to shorten the path to purchase.

Measure like a scientist: run holdout experiments, track incremental lift, and stitch platform conversions back to your order data with server-to-server postbacks. Use short conversion windows for impulse SKUs and longer windows for considered buys. Calculate ACOS and ROAS by SKU and campaign to spot profitable microsegments you can scale.

Launch with a tight hypothesis: pick three to five high-margin SKUs, set conservative bids, and treat the first few weeks as learning. Automate rule-based scaling for winners and cap spend on losers. Treat retail media as a systematic growth channel—test fast, optimize ruthlessly, and move dollars to positions where real purchase intent converts.

CTV Without the Guesswork: Roku, Hulu, and Samsung Ads That Actually Move Product

If you're used to bidding in a crowded auction where CPMs feel personal, welcome to a calmer lane. Roku, Hulu and Samsung let you buy attention at household scale — and when you stop treating CTV like ambient branding and start treating it like store shelf real estate, you can see direct lifts in traffic, cart adds, and the kinds of conversions that make finance teams stop sighing.

Start with creative that respects the big screen: 15–30 second opens that hook visually in the first 3 seconds, a clear product shot at the 10–15 second mark, and a simple, typed CTA (promo code, short URL, QR) that viewers can act on from another device. Pair that creative with tight audience slices — demos, purchase-intent segments, and contextual inventory — then use short flight tests to learn what actually drives measurable lifts, not vanity impressions.

Here's a compact playbook to try now:

- 🔥 Test: Run three variations—hero product, lifestyle, and demo—at micro-budgets to surface a winner.

- 🚀 Scale: When a creative proves out, double down on households and adjacent contextual clusters for efficient reach.

- 🆓 Measure: Use promo codes, dedicated landing pages, and lift tests to attribute sales to CTV with confidence.

The point is to treat CTV like a conversion partner, not an expensive billboard. Run fast experiments, stitch outcomes into your owned channels (email, SMS, retargeting), and optimize toward cost-per-sale. Do that and these platforms stop being curious experiments and start being reliable revenue engines.

Native That Doesn't Feel Spammy: Taboola, Outbrain, and Smarter Contextual

Think of native networks as backstage storytellers: they tuck your offer into editorial feeds so users feel like they are discovering, not being sold to. Taboola and Outbrain shine when you resist flashy pop-sell tactics and lean into curiosity-driven hooks that match publisher tone and intent.

Operationally, do three things: craft headlines that promise a useful idea, pair images with authentic context (no staged clickbait faces), and build landing pages that read like an article continuation rather than an ad billboard. Layer smarter contextual signals — topic clusters, semantic keywords, sentiment and URL-level cues — so placements find attention where intent is natural. Start narrow, test, then scale.

- 🆓 Creative: Headlines that teach, thumbnails that explain — not shock — to boost engaged clickthrough.

- 🤖 Contextual: Match on meaning and sentiment, not just keywords, to lower bounce and improve time on page.

- 🚀 Placements: Favor high-engagement feeds and publishers with proven LTV, then expand by lookalike audiences.

Measure like a scientist: run holdouts and incrementality tests, bucket ROAS by creative set, and rotate winners fast. Native pays off when you prioritize helpful content over hard sells — the result is quieter scale, steadier CPAs, and customers who stick around because they felt helped, not hunted.

Niche Social FTW: Reddit, Pinterest, and LinkedIn That Punch Above Their Weight

Small, focused platforms often deliver outsized returns when you stop treating them like spare change. Reddit reaches hyper engaged tribes, Pinterest is a discovery engine heavy on intent, and LinkedIn lets you sell to titles, not strangers. The trick is not throwing more budget at everything but designing plays that match platform culture and signals. Think of them as scalpel tools, not sledgehammers.

On Reddit, the community is the media buy. Pick three to five niche subreddits, study top posts, and run conversational promoted posts or AMAs that add value. Avoid broad creative and test copy that speaks in the subreddit voice. If you want a no friction way to dip a toe into platform level metrics, try get free reddit followers, likes and views and measure engagement lift.

Pinterest converts intent into clicks: optimize vertical pins, lead with product shots, and lock down keywords in boards. Use rich pins and shopping tags so every saved pin becomes a micro funnel. Creative rule: design for discovery with clean visuals, bold text overlays, and a clear next step that maps to the search phrase so saves turn into visits.

LinkedIn rewards relevance. Swap broad brand pushes for targeted content campaigns aimed at job titles and decision making cohorts. Run short case study carousels, use sponsored InMail for high value prospects, and align lead gen forms to the content promise. Start small, measure CPL and LTV, then scale the channels that actually shrink your CPA.

Programmatic Without the Headache: The Trade Desk, StackAdapt, and Basis You Can Actually Run

Programmatic does not have to feel like signing up for a calculus class. With the right playbook you can run The Trade Desk, StackAdapt, or Basis without hiring an ops army. Think of these platforms as finely tuned engines: they reward clear signals, tidy data, and experiments that are short, measurable, and ruthless about winners and losers.

Start simple: map one high-value audience, pick a single conversion event, and run a three-week test with frequency caps and creative rotations. Use platform-native reporting to validate lift before you scale. Each of the three tools below is battle-tested for performance buyers who want control without the 24/7 troubleshooting headache.

- 🚀 Trade Desk: Best for omnichannel scale and advanced audience stitching; leverage its unified ID and layered lookalikes to lift ROAS without overbidding.

- 🤖 StackAdapt: Great for contextual and connected TV buys; prioritize creative variants and contextual categories that match your product moments.

- ⚙️ Basis: Ideal for streamlined automation and clear pacing controls; use its rules engine to defend margins while scaling across exchanges.

Operational tips to actually win: standardize naming conventions, enforce daily budget pacing, A/B one variable at a time, and export clean attribution windows. If something seems magical, it is usually just a mismatch in signal or a creative that is not resonating. Tweak faster, measure cleaner, and the programmatic headache disappears into predictable ROAS.