Beyond Meta and Google: 15 Ad Networks Your Competitors Hope You Never Find

Retail Media Mavericks: Ride the cash register with Amazon Ads, Walmart Connect, and friends

Think like a store manager who knows where every impulse purchase hides. Retail media networks from Amazon Ads and Walmart Connect to Target Roundel, Instacart and grocery DSPs turn checkout lanes into targeted billboards. These channels serve intent at the cash register, not the feed, so SKU-level creative, inventory-aware bids and listing quality win more than broad awareness bets. Treat each placement like prime shelf space and you will convert consideration into cart velocity.

Start with a tight hypothesis and a tiny test budget. Map top SKUs to campaign types: Sponsored Products for direct conversions, Sponsored Brands for halo effects, and programmatic DSP buys for cross-site audience reach. Automate daily inventory checks to pause ads for out of stock items and sync prices to avoid wasted spend. Measure both add to cart ROAS and margin adjusted CPA, then reroute budget to listings that show repeat purchase signals. Fast experiments and frequent learning beat perfect plans that never ship.

Keep decisions simple with three fast rules:

- 🆓 Test: launch low budget variants on new SKUs to find creative winners without blowing monthly dollars.

- 🚀 Scale: double down on listings that show immediate lift in conversion rate and inventory turns.

- ⚙️ Optimize: feed hygiene, titles, bullets and images matter more on retail platforms than on generic display buys.

Finally, view retail media as a stack not a silo. Sync first party audience signals into DSP buys, test cross platform bundles across Amazon and grocery networks, and carve out a small daily budget for algorithmic learning. Start simple, measure margin not just clicks, and let winning SKUs fund the next round of experiments. Do that and your competitors will wonder what shelf you discovered.

CTV and Streaming Power Plays: Be on the big screen without the big game price tag

Think of connected TV and streaming as the VIP lounge of advertising: big-screen impact without paying Super Bowl rates. The trick is to stop chasing primetime impressions and start slicing inventory into smart, testable pockets. Target by content genre, mood, or episodic binge behavior instead of blasting broad demos; that gives you premium reach with far more efficiency. Swap long ads for punchy creative that honors the living room vibe.

Buying options are the playground: programmatic guaranteed, private marketplaces, and direct deals with publishers all coexist and each has a sweet spot. Start with a handful of PMPs to secure brand-safe shows, then layer in audience-based buys for reach. If you want a fast proof of concept, partner with niche streamers and gaming platforms to stretch budgets and boost engagement—try exploring twitch social media marketing as an experimental channel that plays well on big screens and second screens alike.

Measurement needs to be adaptive. Use household and device graphs to stitch exposure, but validate impact with incrementality tests and incremental KPIs like session lift or app installs. Creative also matters: deliver short cuts, multiple aspect ratios, and companion assets for mobile follow up. Interactive overlays, QR codes, and shoppable CTAs turn passive viewing into measurable action without interrupting the narrative.

Actionable playbook: run small tests, treat CTV as a funnel step not a one-off, and optimize toward cost per engaged minute rather than just CPM. Keep frequency caps friendly, favor contextual alignment over risky behavioral matches, and scale winners into programmatic guaranteed buys. Do this and you will be on the big screen, memorable and efficient, without selling out your whole budget to one Sunday in February.

Native Discovery That Does Not Annoy: Outbrain and Taboola done right

Native discovery networks like Outbrain and Taboola can feel invisible rather than interruptive when campaigns are built around relevance, not noise. Think sponsored recommendations that belong in the feed: match voice, match context, and promise a quick payoff in the headline. When the creative respects the user, engagement climbs and backlash plummets.

Practical playbook: design three thumbnail archetypes — closeup face, product-in-use, and in-context lifestyle — and pair each with five benefit-first headlines of 5 to 7 words. A/B headline and creative separately, and make landing pages mirror the article tone so readers do not bounce. Apply frequency caps and rule-based pausing to limit ad fatigue.

Targeting and bidding advice: begin broad with interest clusters and publisher placements, then narrow based on conversion cohorts. Start with CPC to find strong creatives, then switch to CPA bidding once events are stable. Use retargeting windows to build sequential funnels — discovery to article to conversion — and measure time on page and downstream value.

Experiment blueprint: launch 3 creatives × 5 headlines, run for 7–10 days or 3,000–5,000 impressions per variant, then kill poor performers, scale winners by budget and site placement, and iterate creative hooks. Treat native discovery like content marketing on caffeine: subtle, useful, and engineered to turn curious readers into reliable customers.

B2B Heat Check: LinkedIn plus intent networks your sales team will love

Think of LinkedIn as the control tower for B2B creative and intent networks as the radar that tells you which accounts are taking off. Start by mapping which pages, topics, and product keywords correlate with sales-ready behavior, then funnel those signals into audience lists for LinkedIn and your DSPs. This is where marketing stops guessing and starts handing sales warm leads on a silver platter.

Practically speaking, use intent to prioritize reach and LinkedIn to personalize the message. When an account spikes on intent signals, push a tailored Sponsored Content ad or InMail, align the creative to that intent topic, and instruct SDRs to call with a relevant insight. The window after an intent spike is short; speed and relevance win more deals than splashy creative.

Top intent partners differ by use case, but these three are great starting points:

- 🔥 Bombora: broad market intent scores ideal for account prioritization and lookalike expansion.

- 🤖 G2: buyer-stage signals directly tied to product research and vendor comparisons.

- 💥 6sense: predictive insights plus orchestration for multi-touch account plays.

Run a tight experiment: pick 50 target accounts, layer Bombora or G2 intent, activate a 3-week LinkedIn sequence with matching landing pages, and measure MQL to opportunity velocity. Keep creatives short, challenge assumptions, and brief sales on the exact intent phrase so their outreach sounds informed, not canned. Iterate weekly; your sales team will thank you when pipeline warms up faster than the coffee machine.

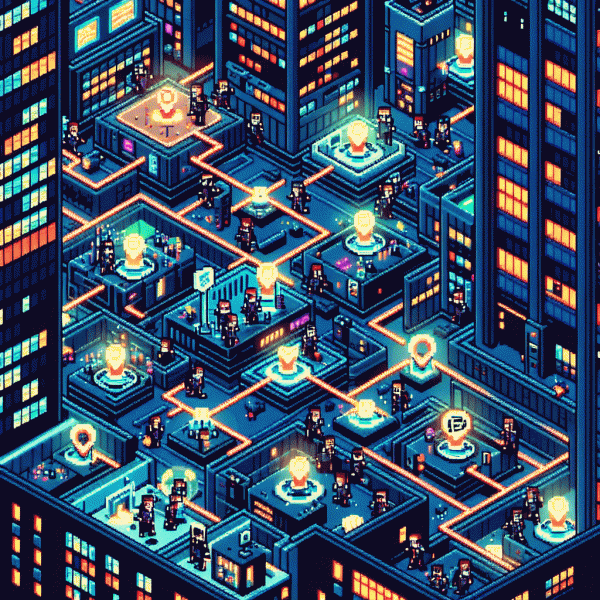

Mobile and Gaming Real Estate: In app attention that actually converts

Think of mobile gaming as premium billboard space inside a living room of one player at a time: high dwell, low distraction, and an appetite for rewards. Ads that respect the gameplay loop actually get watched, played, and clicked. That means formats like rewarded video that pay off instantly, short playable demos that let prospects try before they buy, and well timed native placements that match the look and feel of the app will outperform generic banners every time.

Creative is the conversion engine. Open with value in the first two seconds, show utility or fun, and end with a clear next step backed by a deep link that lands users at the right moment. Swap static assets for short interactive hooks, compress offers into one screen, and use localized creative to match player culture. Keep messaging simple: reward, benefit, click. Test variations of reward size and placement to map the point of diminishing returns.

Measurement is non negotiable. Instrument SDK events for install to first purchase, track day 1 and day 7 retention, and measure true CPA and LTV per placement. Use cohort analysis to separate high value placements from attention sinks, and enforce frequency caps so novelty does not decay into annoyance. Look for partners that provide clean postback options and transparent viewability metrics.

Action plan: pilot three gaming focused networks, run a creative bundle for two weeks, and promote winners while killing losers fast. Negotiate SDK access and mediation to control spend, set smart bid floors aligned with LTV, and schedule creative refreshes like a drip campaign. Do this and you will unlock in app attention that actually converts instead of just generating impressions.